The new ouguiya, the Mauritanian currency, which loses a zero compared to the old, came into circulation on Monday, forcing many banks to exceptionally open to customers on January 1, according to AFP.

From this 1st of January 2018, ten ouguiyas become an ouguiya. This measure, announced on the national holiday on November 28 by President Mohamed Ould Abdel Aziz, will, is meant to help the ‘‘ouguiya to resume its place in financial transactions, to protect the purchasing power of the citizen and reduce the amount of money in circulation. “

The old banknotes and coins will be withdrawn according to a schedule established by the Central Bank of Mauritania (BCM), starting with the largest ones, such as the 5,000 (11.76 euros) banknote by 31 January, the 2,000 and 1,000 respectively one and two months later, the smallest by June.

“We are there until noon (local time and GMT) at the request of the government, we are at the service of our customers after a long weekend,” a teller of the BCI (Mauritanian bank for trade international) where small queues of users were formed told AFP.

The banking institutions have changed their software, checkbooks, and reconfigured their ATMs to bring them into compliance with the new ouguiya.

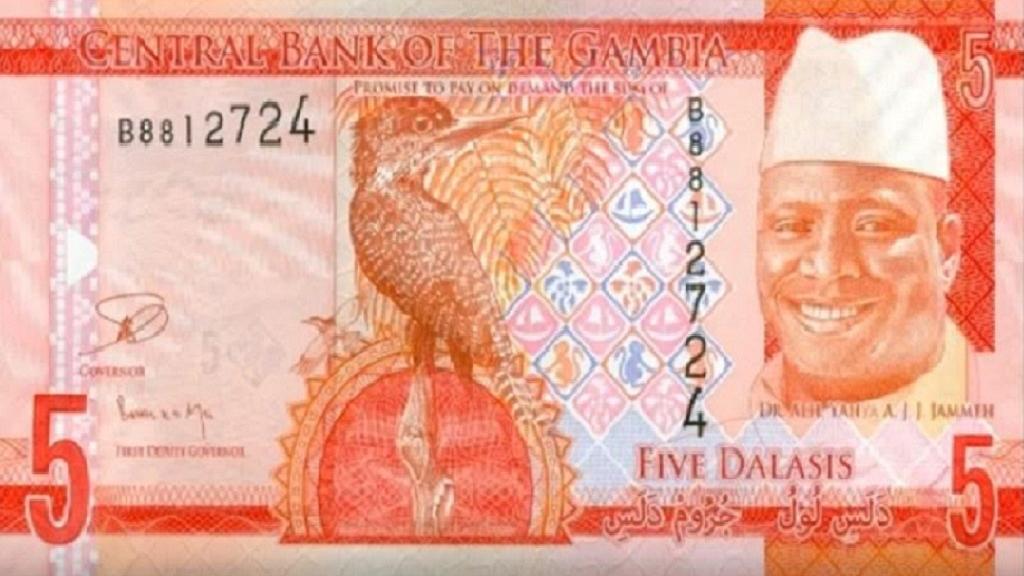

In the streets, the people already served were examining the new polymer banknotes, turning and flipping them around, contemplating their bright colors and testing their vaunted solidity by the Central Bank.

The removal of old banknotes and coins aims to protect the national currency “against forgery and replace it with stronger, safer, more durable and more innovative series,” says the BCM in multiple press releases.

In early December, the BCM’s governor, Abdel Aziz Ould Dahi, denied rumors of “devaluation” of the ouguiya, assuring that it “would retain its value and the purchasing power of the citizens would not suffer” .

Even before the announcement of the release of the new notes, the ouguiya lost in recent months its value on the black market against the euro and the dollar, but the trend has worsened since, due to an increase in the demand for foreign currency.

In 2004, Mauritania replaced all banknotes in circulation since 1974.

*AFP*