The Social Security and National Insurance Trust (SSNIT) has taken a giant step to rope in self-employed workers largely in the informal sector unto a basic pension scheme.

1st tier SSNIT pensions have conventionally been patronized by formal institutions legally charged with the mandate to pay contributions on behalf of their workers.

Though the law that establishes the trust makes provision for all other workers including the self-employed to enroll on the pension scheme, voluntary subscription has been incredibly low with just 2% of the informal sector enrolled on the national pensions trust.

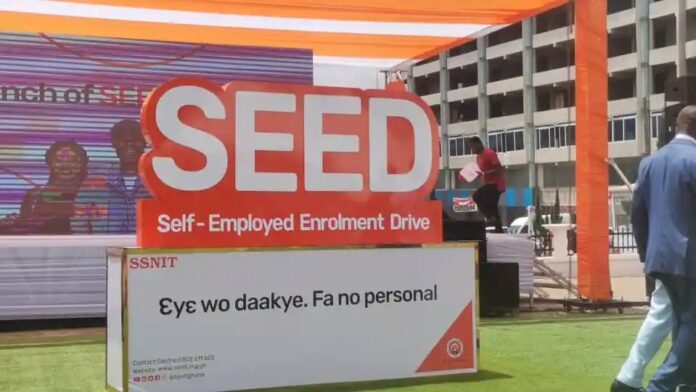

The Self Employed Enrollment Drive (SEED) an innovation of the Social Security and National Insurance Trust is to afford some 9 million informal sector workers, a flexible scheme to enjoy guaranteed benefits on retirement and unforeseen incidents of invalidity.

Launching the drive in the Central Business District of Kumasi, the Director General of SSNIT Dr. John Ofori Tenkorang pointed out that the drive will fix what he called the lopsided state of pension coverage.

He explained, “What we are offering is an opportunity for them to insure their incomes so it can be replaced when they are old or become invalid and cannot work again. The same Scheme will also pay a benefit to their survivors if they pass on.”

Deputy Minister of Employment and Labor Relations Bright Wreko Brobey pointed out that the scheme will not rival but compliment the second and third tier pension contributions under the National Pensions Regulatory Authority.

He further gave assurances that government remained committed to enhancing Ghana’s security safety nets by offering guaranteed protection for pension contributions.

78 year old Board Chair of SSNIT Elizabeth Ohene was worried only 11% of her compatriots above 60 years are documented to be covered under a pension scheme.

She charged the youth to avoid making the same mistakes that has rendered over 2 million pensioners dependent on handouts for a living.

Leaders of various recognized transport and trader groupings who were enthralled by the initiative, however took it hard at SSNIT for failing to roll out the policy on time as a majority of their established members had crossed the 45 year eligibility threshold.

SSNIT is expected in the coming days to hit the various market centers, Commercial Business Hubs, Religious Institutions and places of public convergence to ensure that it moves the number of informal sector workers on the scheme from its diminutive level to an appreciable coverage.

Some 1.9 million of the estimated 10 million workers in the country are covered under the SSNIT Scheme with a meagre 32,000 comprised of informal workers.

Out of the two million people above 60 years in Ghana, only 11% receive regular pensions widening the dependency ratio and stretching the incomes of the economically active proportion of the country’s population.

By: Ivan Heathcote – Fumador