A consortium led by Africa-focused power producer Endeavor Energy has begun building a US$552 million, 200-megawatt power plant in the country

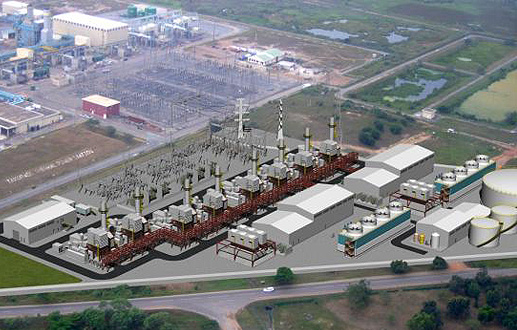

The plant Amandi Energy Power Plant (Amandi Project) being built at Aboadze in the Western Region will be a combined cycle, dual-fuel power facility. It is due to come online in April 2019 and is the only large scale base-load independent power generation project in sub-Saharan Africa to achieve financial close to date in 2016.

The Amandi Project will be crucial in helping to meet the country’s growing power needs. Once constructed, the plant will be one of the most efficient power plants in the country and will produce more than 1,600 gigawatt hours per year, energising up to one million Ghanaian households. Amandi Energy will sell power to the Electricity Company of Ghana (ECG) under a 25-year Power Purchase Agreement. It will be initially fueled by light crude oil, but is expected to switch to indigenous gas from Ghana’s offshore Sankofa natural gas field once available.

The plant’s construction will create 400 jobs, most of which will be filled by Ghanaians, and the plant’s operations will employ up to 40 people full time.

Amandi Energy was founded by a consortium of developers with extensive experience of doing business in Ghana and elsewhere in sub-Saharan Africa (Amandi Founder Group or AFG). For the Amandi Project, AFG has, prior to financial close, partnered with majority owner of the project Endeavor Energy (Endeavor), a leading Africa-focused independent power company backed by global private equity firm Denham Capital, and Aldwych International (Aldwych), a prominent developer, owner and operator of power generation projects in sub-Saharan Africa.

The US$552 million investment required for the Amandi Project comprises US$134 million in equity from the sponsor group, which includes Endeavor, AFG, Aldwych, Pan African Infrastructure Development Fund 2 managed by Harith General Partners (PAIDF2), and ARM-Harith Infrastructure Fund (ARMHIF). The US$418 million in debt financing is provided by a group of lenders, including the U.S. Government’s development finance institution Overseas Private Investment Corporation (OPIC), which will provide a US$250 million loan, as well as CDC Group plc, which will provide an US$83 million loan, Nedbank Limited and Rand Merchant Bank.

The Amandi Project signifies another achievement for the U.S. Power Africa programme, as OPIC’s funding is the initiative’s largest investment in West Africa to date. As Power Africa partners, OPIC, Denham Capital, Endeavor and Aldwych seek to make a difference with their projects throughout the continent by working with national governments and local stakeholders to build the capacity necessary to help meet critical demands for new electricity supplies.

A spokesperson from Amandi Energy commented: “We started this journey four years ago with a strong belief in the Ghanaian power sector and a commitment to contribute to its growth and success, and have been able to build a strong management team focused on delivering this complex transaction. We have excellent working relations with our partners Endeavor and Aldwych, which have allowed us to bring this project to financial close on a timely basis.”

Sean Long, CEO of Endeavor, added: “Ghana embarked on a mission to strengthen its power sector that has now created an opportune time for international investing. We are very pleased to be working with Ghana’s government and the ECG, as well as the Amandi Founder Group and Aldwych, to realise this project. We’re also proud of the Denham Capital and Endeavor teams for successfully working with our committed partners to achieve financial close on the required $418 million of debt financing for the Amandi Project while at the same time continuing to execute on other important power projects across the continent.”

Helen Tarnoy, Managing Director of Aldwych, said: “Aldwych International acted as co-developer and technical partner through 2.5 years of development and we are delighted to see the successful conclusion of this effort.”

Harith CEO and Chairman of Aldwych, Tshepo Mahloele, further added: “The financial close of the Amandi Project represents a critical moment in addressing Africa’s growing demand for reliable power infrastructure and the persistent lack of properly packaged, bankable projects in the energy space. The project will assist Ghana by realising its developmental objectives and unleashing the country’s industrial potential.”

“Additional power is critical to Ghana as it seeks to meet ever increasing demand and OPIC is proud that this project will help support that,” said Elizabeth L. Littlefield, OPIC President and CEO. “OPIC’s financing and reinsurance will enable the construction of a combined cycle gas turbine power plant that, not only will meet the energy demands, but looks to further develop its economy by creating jobs for local Ghanaians.”

Holger Rothenbusch, CDC’s Managing Director, Debt, concluded: “We are very pleased to be part of this project which is our largest debt commitment in Africa to date and has the potential to create thousands of direct and indirect jobs in the region, not to mention boosting existing businesses through more consistent access to power.” – B&FT